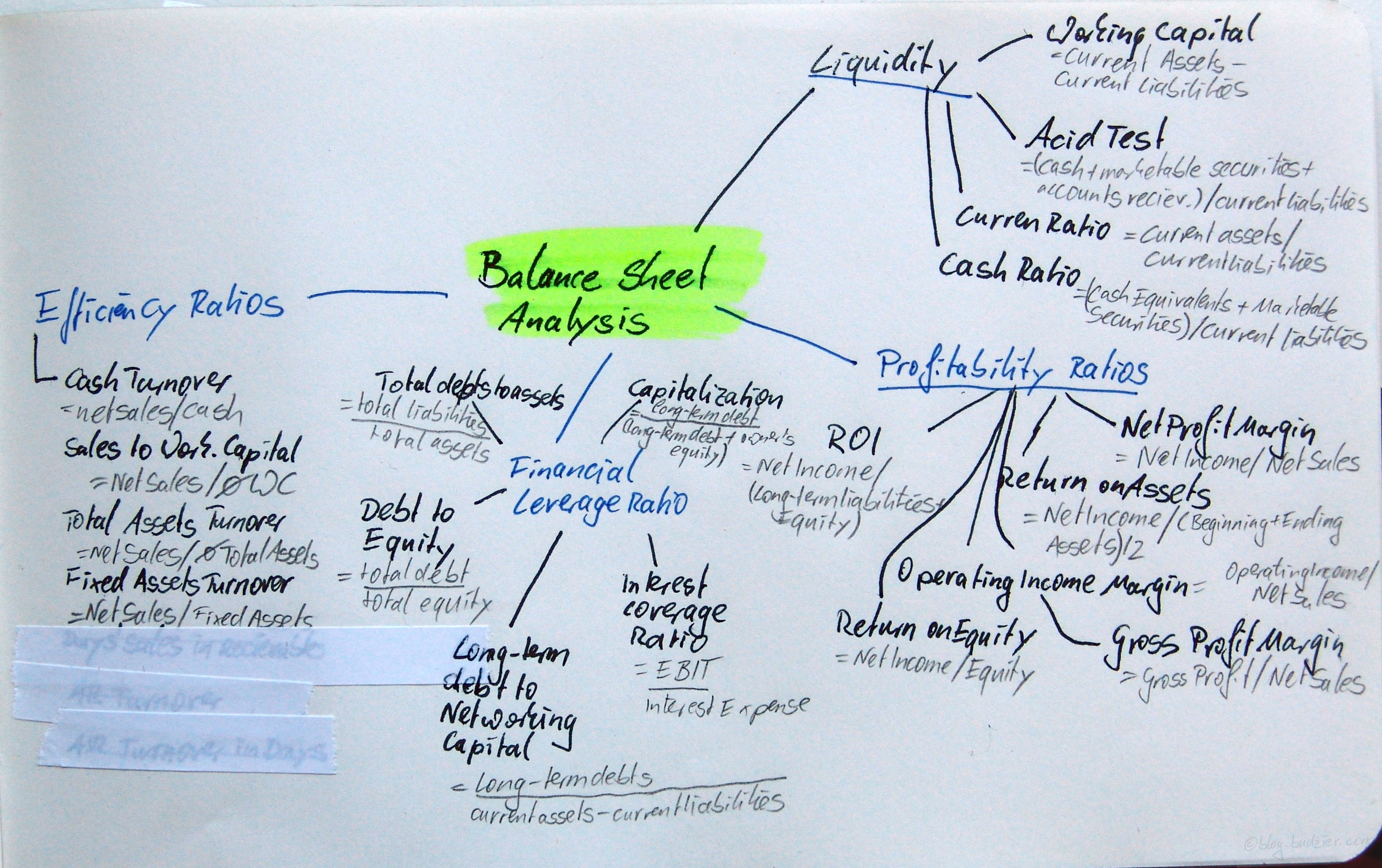

After the monstrous write-up of the Bredillet article on the MAP method, I just wanted to quickly write this down. I did a quick overview of the usual suspects when it comes to Balance Sheet Analysis. There are four major categories I) Liquidity, II) Profitability Ratios, III) Financial Leverage Ratio, IV) Efficiency Ratio.

I) Liquditiy

- Working Capital = current assets – current liabilities

- Acid Test = (cash + marketable securities + accounts receivable) / current liabilities

- Current Ratio = current assets / current liabilities

- Cash Ratio= (cash equivalents + marketable securities) / current liabilities

II) Profitability

- Net Profit Margin = net income / net sales

- Return on Assets = net income / ((beginning of period + end of period assets)/2)

- Operating Income Margin = operating income / net sales

- Gross Profit Margin = gross profit / net sales

- Return on Equity = net income / equity

- Return on Investment = net income / (long-term liabilities + equity)

III) Financial Leverage

- Capitalisation = long-term debt / (long-term debt + owner’s equity)

- Interest Coverage Ratio = EBIT / interest expense

- Long-term debt to net working capital = long-term debt / (current assets – current liabilities)

- Debt to Equity = total debt / total equity

- Total debts of assets = total liabilities / total assets

IV) Efficiency

- Cash Turnover = net sales / cash

- Sales to Working Capital = net sales / average working capital

- Total Assets Turnover = net sales / average total assets

- Fixed Assets Turnover = net sales / fixed assets

[…] Balance Sheet Analysis […]