Jiménez, Luis González; Pascual, Luis Blanco: Multicriteria cash-flow modeling and project value-multiples for two-stage project valuation; in: International Journal of Project Management, Vol. 26 (2008), No. 2, pp. 185-194.

http://dx.doi.org/10.1016/j.ijproman.2007.03.012

I am not the expert in financial engineering, though I built my fair share of business cases and models for all sorts of projects and endeavours. I always thought of myself as being not to bad at estimating and modelling impacts and costs, but I never had a deep knowledge of valuation tools and techniques. A colleague was claiming once that every business case has to work on paper with a pocket calculator in your hands. Otherwise it is way to complicated. Anyhow, I do understand the importance of a proper NPV calculation, to say the least even if you do fancy shmancy real options evaluation as in this article here, the NPV is one of the key inputs.

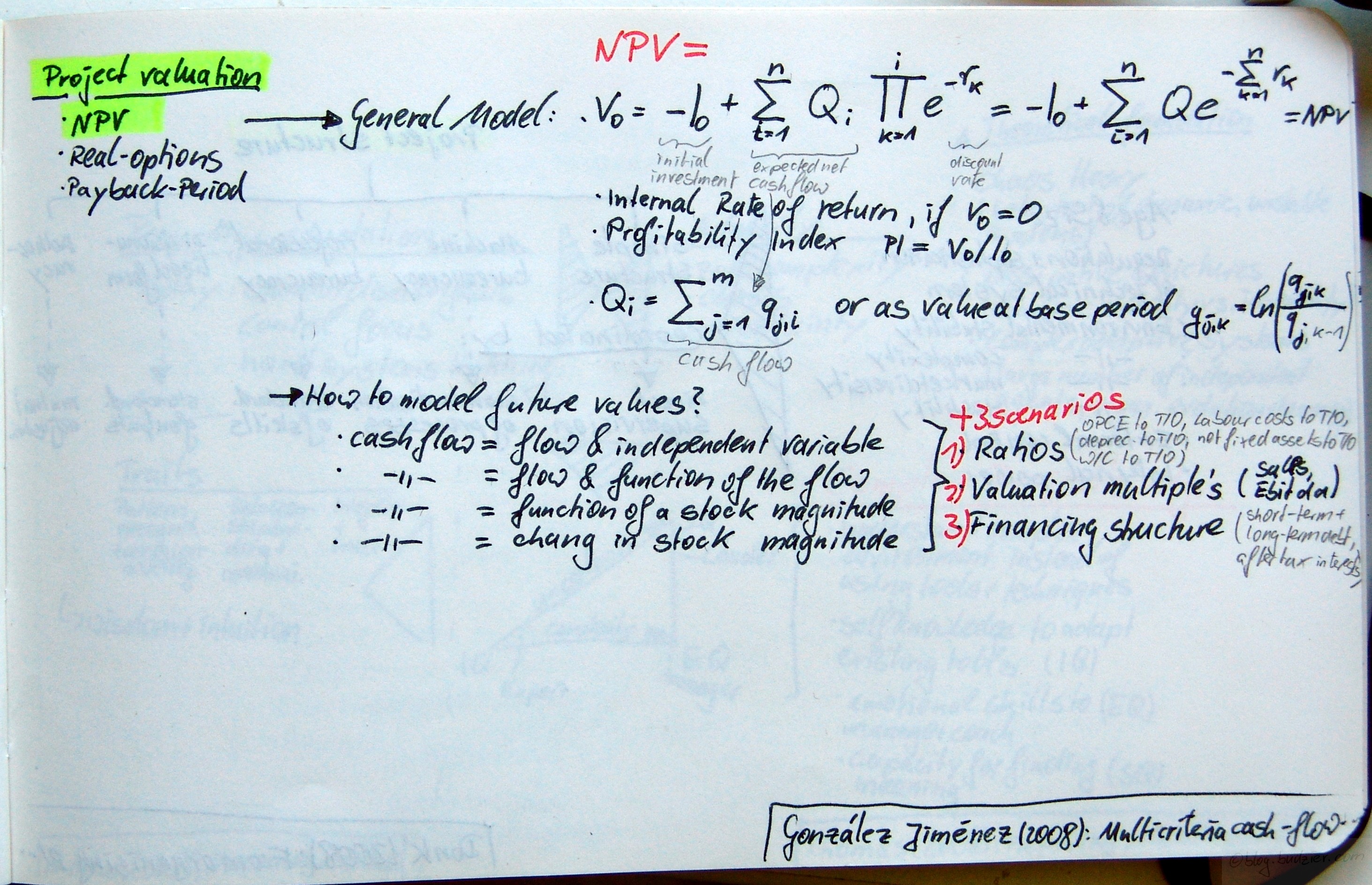

Jiménez & Pascual identify three common approaches to project valuation NPV, real options, and payback period calculations. Their article focusses on NPV calculation. They argue that a NPV calculation consists of multiple cash flow components and each of these has different underlying assumptions, as to it’s risk, value, and return.

The authors start with the general formula for a NPV calculation

NPV = V0 = -I0 + ∑Qi ∏e-rk = -I0 + ∑Q e-∑rk

This formula also gives the internal rate of return (IIR) if V0=0 and the profitability index (PI) is defined as PI = V0/I0. Furthermore Jiménez & Pascual outline two different approaches on how to model the expected net cash flow Qi either as cash flow Qi = ∑qj,i or as value based period gj,k = ln (qj,k/qj,k-1).

The next question is how to model future values of the cash flow without adjusting your assumptions for each and every period. The article’s authors suggest four different methods [the article features a full length explanation and numerical example for each of these]

- Cash Flow = Cash Flow + independent variable

- Cash Flow = Cash Flow + function of the cash flow

- Cash Flow = Function of a stock magnitude

- Cash Flow = Change in stock magnitude

Finally the authors add three different scenarios under which the model is tested and they also show the managerial implications of the outcome of each of these scenarios

- Ratios, such as operating cost and expenses (OPCE) to turnover (T/O), labour costs to T/O, depreciation to TIO, not fixed assets to T/O, W/C to T/O

- Valuation multiples, such as Sales, Ebitda

- Financing structure, such as short term, long term debt, after tax interests

[…] Original Alex […]

[…] Go to the author’s original blog: Multicriteria cash-flow modeling and project value-multiples for … […]

Private student loans…

This site has tons of information about private student loans and loan consolidation….