Chen, Chen-Tung; Cheng, Hui-Ling: A comprehensive model for selecting information system project under fuzzy environment; in: International Journal of Project Management, in press.doi:10.1016/j.ijproman.2008.04.001Update: this article has been published in: International Journal of Project Management Vol. 27 (2009), No. 4, pp. 389399.Upfront management is an ever growing body of research and currently develops into it’s own profession. In this article Chen & Cheng propose a model for the optimal IT project portfolio selection. They outline a seven step process from the IT/IS/ITC project proposal to the enterprise success

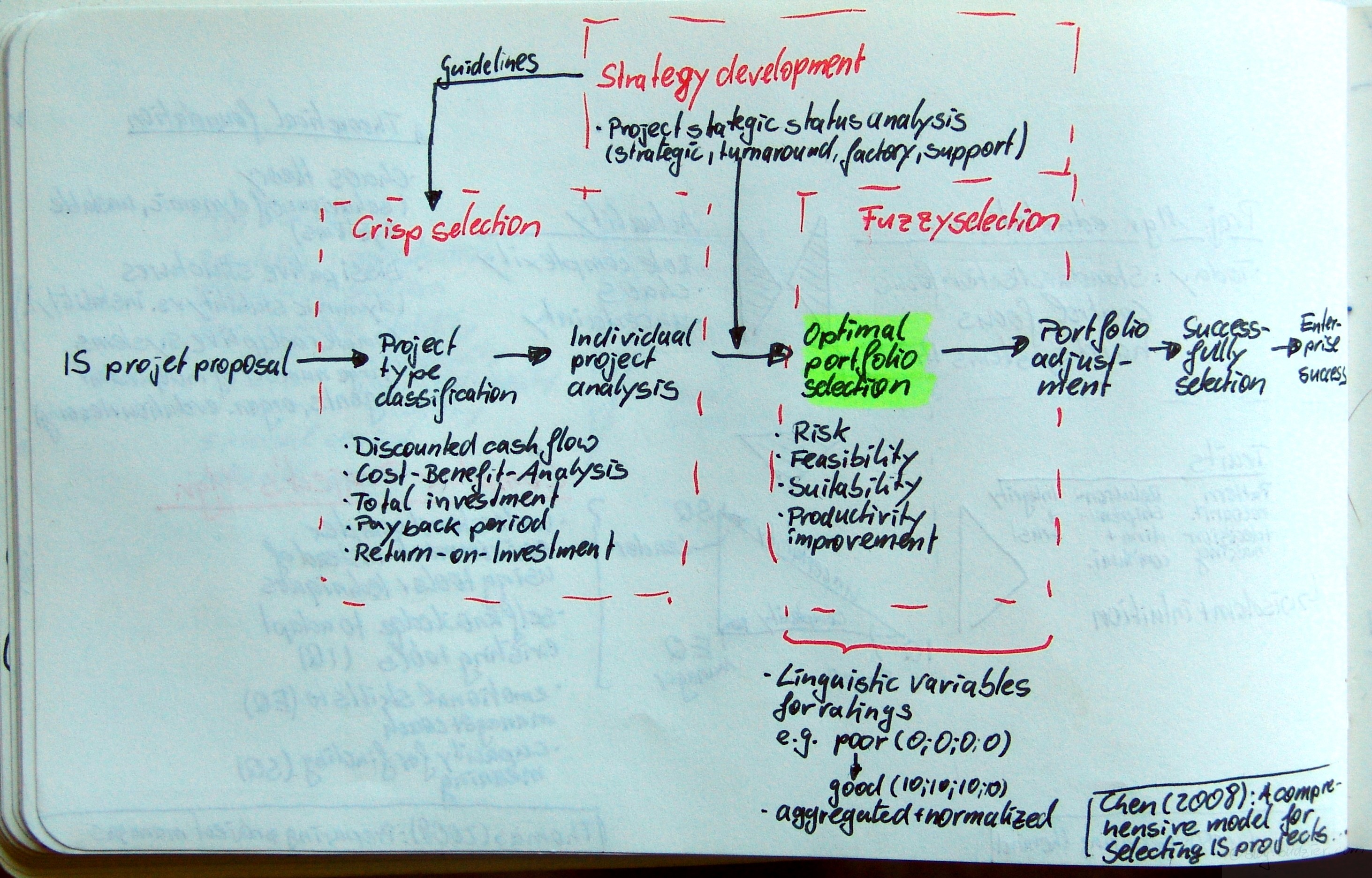

Chen, Chen-Tung; Cheng, Hui-Ling: A comprehensive model for selecting information system project under fuzzy environment; in: International Journal of Project Management, in press.doi:10.1016/j.ijproman.2008.04.001Update: this article has been published in: International Journal of Project Management Vol. 27 (2009), No. 4, pp. 389399.Upfront management is an ever growing body of research and currently develops into it’s own profession. In this article Chen & Cheng propose a model for the optimal IT project portfolio selection. They outline a seven step process from the IT/IS/ITC project proposal to the enterprise success

- IS/IT/ITC project proposal

- Project type classification

- Individual project analysis

- Optimal portfolio selection

- Portfolio adjustment

- Successfully selection

- Enterprise success

Behind the process are three different types of selection methods and tools – (1) crisp selection, (2) strategy development, and (3) fuzzy selection.The crisp selection is the first step in the project evaluation activities. It consists of different factual financial analyses, e.g. analysis of discounted cash flow, cost-benefits, total investment, payback period, and the return on investment.Strategy development is the step after the crisp selection, whilst it also impacts the first selection step by setting guidelines on how to evaluate the project crisply. Strategy development consists of a project strategic status analysis. According to Chen & Cheng’s framework a project falls in one of four categories – strategic, turnaround, factory, or support.The last step is the fuzzy selection. In this step typical qualitative characteristics of a project are evaluated, e.g., risk, feasibility, suitability, and productivity improvements. In this step lies the novelty of Chen & Cheng’s approach. They let the evaluators assign a linguistic variable for rating, e.g., from good to poor. Then each variable is translated into a numerical value, e.g., poor = 0, good = 10. As such, every evaluator produces a vector of ratings for each project, e.g., (0;5;7;2) – vector length depends on the number of characteristics evaluated. These vectors are then aggregated and normalised.[The article also covers an in-depth numerical example for this proposed method.]